Expat LivingFinancial PlanningInternational FinanceInvestment GuidesUK Economy

Navigating Investment Opportunities in the UK for Expatriates: A Comprehensive Guide

Introduction: The UK as a Hub for Expat Investment

The United Kingdom, with its robust economy, stable political environment, and sophisticated financial markets, presents a compelling landscape for expatriates seeking to grow their wealth. For individuals residing or planning to reside in the UK, understanding the unique investment opportunities and regulatory nuances is paramount. This article aims to provide an academic overview of key investment avenues and critical considerations for expats in the UK.

Understanding the UK Investment Landscape for Expats

Expats engaging with the UK financial system must contend with specific regulatory and taxation frameworks. A fundamental grasp of these elements is essential for informed decision-making.

Key Regulatory Frameworks

The UK’s financial services industry is primarily regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). These bodies ensure consumer protection and market integrity, providing a secure environment for investors. Familiarity with their roles helps expats identify legitimate investment products and services.

Taxation Regimes for Expatriates

Taxation is a critical aspect of investment planning for expats. The UK’s tax system is complex and depends heavily on an individual’s residency and domicile status. Key taxes include Income Tax, Capital Gains Tax (CGT), and Inheritance Tax (IHT).

- Residency and Domicile: An expat’s tax liability in the UK is significantly influenced by their tax residency status and domicile (origin vs. choice). Non-domiciled individuals may be eligible for the ‘remittance basis’ of taxation, which can impact how overseas income and gains are taxed.

- Capital Gains Tax (CGT): CGT is levied on profits made from selling assets, such as shares or property. Exemptions and allowances exist, and rates can vary based on the type of asset and the individual’s income bracket.

- Inheritance Tax (IHT): IHT is charged on the value of an individual’s estate upon death. For non-domiciled individuals, UK IHT generally applies only to UK-situated assets, though this can become complex with deemed domicile rules.

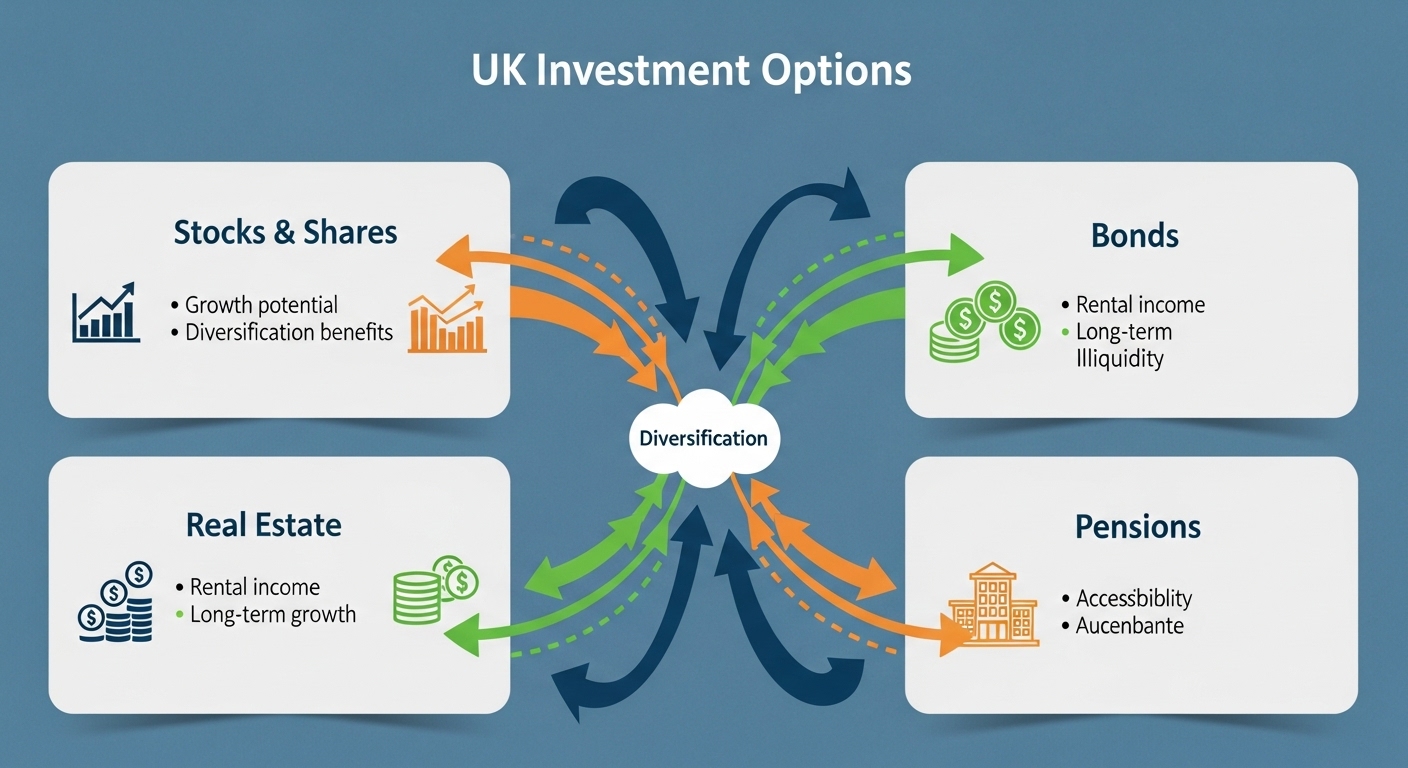

Primary Investment Avenues for Expats

The UK offers a broad spectrum of investment opportunities catering to various risk appetites and financial objectives.

Real Estate Investment

UK real estate remains an attractive option, particularly in major urban centers. Expats can invest in both residential and commercial properties.

- Residential Property: This includes owner-occupier homes and ‘Buy-to-Let’ properties. Buy-to-let investments can generate rental income and potential capital appreciation, though they come with associated responsibilities and specific tax implications (e.g., Stamp Duty Land Tax, mortgage interest relief restrictions).

- Commercial Property: Investment in commercial real estate (offices, retail, industrial units) can offer diversification from residential holdings but typically requires higher capital and carries different risk profiles.

Capital Markets

The UK’s capital markets are highly developed, offering access to a wide range of securities.

- Stocks and Shares: Expats can invest in individual equities listed on the London Stock Exchange (LSE). Accessing these through platforms like Individual Savings Accounts (ISAs) can provide tax-efficient growth, as gains and income within ISAs are generally tax-free.

- Bonds and Gilts: Government bonds (gilts) and corporate bonds offer a lower-risk investment profile compared to equities, providing fixed income streams. They can play a role in portfolio diversification.

- Managed Funds: Investment funds, such as Exchange Traded Funds (ETFs), mutual funds, and investment trusts, offer diversified exposure to various asset classes or sectors, managed by professional fund managers. These are particularly suitable for expats who prefer a hands-off approach to investment management.

Pensions

Planning for retirement is crucial for expats. The UK offers several pension options.

- UK Pension Schemes: Workplace pensions and Self-Invested Personal Pensions (SIPPs) allow individuals to contribute to a pension pot, often with tax relief, and invest it across a range of assets.

- International Pension Transfers (QROPS): For expats moving to or from the UK, transferring overseas pensions into a Qualified Recognised Overseas Pension Scheme (QROPS) can be a viable strategy, subject to specific conditions and tax considerations.

Strategic Considerations for Expat Investors

Beyond the investment products themselves, expats must consider broader strategic factors.

Currency Risk Management

Investing in a currency different from one’s primary income or future expenditure currency introduces exchange rate risk. Expats should consider hedging strategies or diversify their investments across multiple currencies to mitigate this risk.

Estate Planning and Succession

Cross-border estate planning is complex. Expats need to understand how UK inheritance laws interact with the laws of their home country and any other countries where they hold assets. Drafting a UK-specific will is often advisable.

Professional Financial Advice

Given the complexities of international taxation, residency rules, and diverse investment options, seeking advice from a qualified financial advisor specializing in expat finances is highly recommended. Such an advisor can provide tailored strategies that align with an individual’s financial goals and legal obligations.

Conclusion

The UK presents a dynamic and opportunity-rich environment for expatriate investors. From property to capital markets and pensions, a wide array of options exist. However, the intricacies of tax, regulation, and cross-border financial planning necessitate a thorough understanding and often, the guidance of specialist professionals. Expats who engage proactively with these considerations are better positioned to achieve their financial objectives in the United Kingdom.