Navigating the Complexities: A Guide to Tax Planning Services for Expats in the UK

Introduction: The Imperative of Strategic Tax Planning for UK Expats

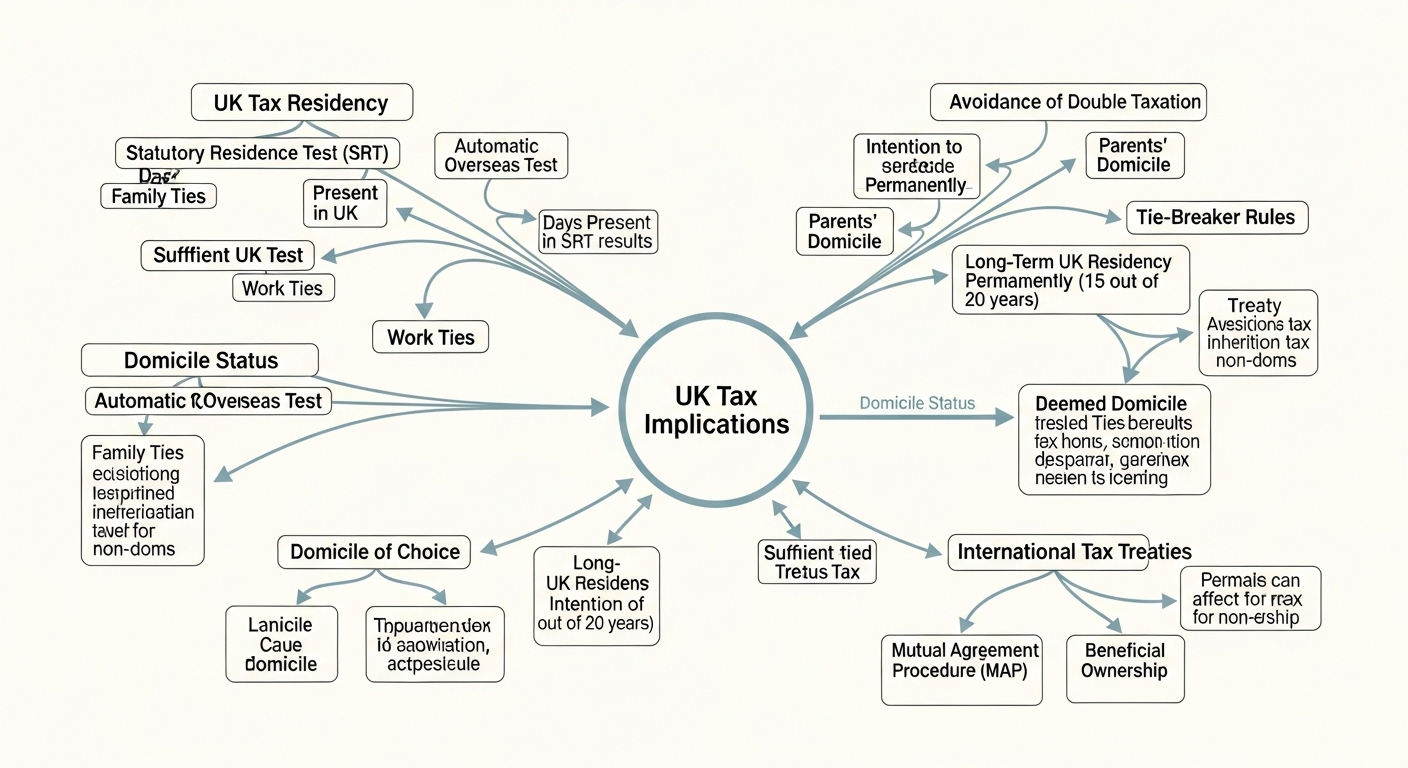

Expatriates residing in the United Kingdom face a unique and often intricate tax landscape. The interplay of UK tax regulations, international tax treaties, and individual residency and domicile statuses creates a complex environment that necessitates careful and proactive tax planning. Without expert guidance, expats risk non-compliance, missed tax efficiencies, and potentially significant financial repercussions. This article delves into the critical aspects of tax planning services available to expatriates in the UK, highlighting their importance and the benefits of professional consultation.

Understanding Expat Tax Status in the UK: Residency and Domicile

The foundation of effective tax planning for expats hinges on a clear understanding of their tax status within the UK. This primarily revolves around two key concepts: residency and domicile.

Residency Status: The Statutory Residence Test

An individual’s UK tax residency status determines their liability to UK income tax and capital gains tax. The Statutory Residence Test (SRT) provides a comprehensive framework for determining whether an individual is a UK resident for a particular tax year. This test considers factors such as days spent in the UK, ties to the UK (e.g., family, accommodation, work), and ties to other countries. Being deemed a UK resident generally means being subject to UK tax on worldwide income and gains, though exceptions apply based on domicile and the remittance basis of taxation.

Domicile Status: Ordinary Residence vs. Domicile of Origin

Domicile is a distinct legal concept from residency, referring to an individual’s permanent home. It is primarily determined by common law and can be a domicile of origin (acquired at birth), a domicile of dependence (acquired from another person), or a domicile of choice (chosen by an individual). An individual’s domicile status significantly impacts their liability to UK Inheritance Tax and their ability to claim the remittance basis of taxation for income and capital gains. Non-domiciled individuals, particularly those who are non-resident in the UK for a significant period or are newly arrived, may elect to be taxed on the ‘remittance basis,’ meaning they only pay UK tax on foreign income and gains that are brought into or enjoyed in the UK.

Key Tax Areas for Expats Requiring Planning

Expats must navigate several critical tax areas, each presenting specific planning opportunities and challenges.

Income Tax Considerations

Expats often have diverse income streams, including salaries, business profits, rental income from overseas properties, and investment returns. Proper planning involves understanding how these different income types are taxed in the UK, considering any applicable double taxation treaties, and optimizing allowances and reliefs.

Capital Gains Tax (CGT)

Disposing of assets such as property, shares, or other investments can trigger Capital Gains Tax. For expats, the taxability of these gains depends heavily on residency, domicile, and the location of the asset. Strategic timing of disposals and effective use of available exemptions are crucial.

Inheritance Tax (IHT)

Inheritance Tax is levied on an individual’s estate upon death and certain lifetime gifts. An expat’s domicile status is paramount in determining the scope of their estate subject to UK IHT. Non-domiciled individuals are generally only subject to UK IHT on their UK-situated assets, whereas deemed domiciled or domiciled individuals are subject to IHT on their worldwide assets. Planning involves structuring asset ownership and wills strategically.

Overseas Pensions and Investments

Managing overseas pensions and investments requires expert knowledge to ensure compliance with UK tax rules and to avoid unnecessary tax liabilities. This includes understanding Qualifying Recognised Overseas Pension Schemes (QROPS), tax implications of foreign investment income, and reporting obligations.

The Indispensable Role of Professional Tax Planning Services

Engaging specialist tax planning services offers significant advantages for expats, extending beyond mere compliance.

Ensuring Compliance and Mitigating Risk

UK tax law is dynamic and complex. Professional advisors ensure that expats meet all their reporting obligations to HMRC, correctly declare all relevant income and gains, and avoid penalties for non-compliance. This includes assistance with self-assessment tax returns and navigating intricate international reporting requirements.

Optimising Tax Efficiency

Expert tax planners identify legitimate opportunities to reduce an expat’s overall tax burden. This might involve advising on the remittance basis, structuring investments in a tax-efficient manner, utilising available tax reliefs and allowances, and planning for eventual repatriation or departure from the UK.

Navigating International Tax Treaties

The UK has an extensive network of double taxation agreements with other countries. These treaties aim to prevent individuals from being taxed twice on the same income or gains. Professional advisors are adept at interpreting and applying these treaties to an expat’s specific circumstances, ensuring they benefit from treaty provisions.

Selecting the Right Tax Advisor

When seeking tax planning services, expats should prioritize advisors with specific expertise in international taxation and expat affairs. Key considerations include: extensive experience with the Statutory Residence Test and domicile rules, a deep understanding of international tax treaties, and a client-focused approach that tailors advice to individual circumstances. Reputable firms often have multidisciplinary teams capable of addressing a wide range of financial and legal aspects related to expat life.

Conclusion: Proactive Planning for Financial Security

For expatriates in the UK, proactive and informed tax planning is not merely advisable but essential. The intricacies of UK residency, domicile, and international tax regulations demand a sophisticated approach that professional tax planning services are uniquely positioned to provide. By leveraging expert advice, expats can ensure compliance, optimize their tax position, and achieve greater financial certainty and peace of mind during their time in the United Kingdom.